Gold has been a symbol of wealth and a cornerstone of the global economy for centuries. Its allure and intrinsic value have spurred numerous gold rushes throughout history, altering the course of nations. South Africa’s gold deposits have been a particularly significant player in the global market. The discovery of gold in 1886 positioned South Africa as a major contributor to the world’s gold reserves, with the country historically contributing up to 50% of all the gold ever mined and substantally influencing the global economy.

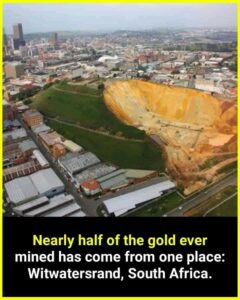

While investigating my daring escape from the Nazi article I fell into a rabbit hole of discovery about Gold in WWII. The meme on the right spurred me onto writing the rest of this article and the checkered history of Gold Worldwide.

While investigating my daring escape from the Nazi article I fell into a rabbit hole of discovery about Gold in WWII. The meme on the right spurred me onto writing the rest of this article and the checkered history of Gold Worldwide.

Backstory to the Gold Meme –>

The Witwatersrand in South Africa is home to what may be the world’s most abundant resource of extractable gold, surpassing even the vast quantities believed to be dissolved in the planet’s oceans, sediments, and oceanic crust. South African currency, the rand, is named after the WitwatersRand, the ridge upon which Johannesburg stands and where the country’s major gold deposits were discovered.

While estimates suggest that there are about 13,500 tonnes of gold in all the Earth’s oceans, the Witwatersrand (on it’s own) has produced approximately 50,200 tonnes since mining began in 1886, with a now estimated 48,100 tonnes still to be extracted.

To put that into perspective, it would take approximately 2,008 standard 20-foot shipping containers to holding 25 tonnes each. Laid end to end, these containers would stretch over a kilometer.

It is believed that approximately 86% of all the gold currently above ground has been mined in the past two centuries.

Using words like “approximately”, “estimated” and “believed” are appropriate in so far as the “official records” are far from exact – (as I uncover later in this post).

1852 at the Pardekraal farm in Krugersdorp, the early prospector John Henry Davis discovered gold. At that time South Africa was a wilderness with the inner regions inhabited by only a few farmers. Davis’s discovery was poorly documented event and remained largely unknown to the general public. While other records of similar gold discoveries purport to alluvial gold found in the Jukskei River date as far back as 1834, there is little by way of evidence (as is the nature of gold discovery).

Whether muted by the south African govenment of the era, or lost in poor record keeping, by 1886 the cat was out the proverbial bag.

South Africa’s gold mining modest production grew from few hundred kilograms in 1886 (largely an exercise to draw the attention of investors) to industrial proportions. At its zenith in 1970, South Africa’s gold production reached a record of 1,002 tonnes, the highest annual output ever achieved by a single country (on record). The discovery of gold reefs in the Witwatersrand had sparked a series of events which completely transformed not only the region but the International Monetary System and arguably the financial foundations of some of the worlds biggest superpowers as we know them today.

Prospectors from the United Kingdom and United States flocked to this little known area (at the time) and ultimately led to the establishment of early Johannesburg, a city which would grow to become the largest city in Southern Africa. Over the next few decades South Africa grew into the world’s largest gold producer and held that title for the most part of the 20th century.

By the end of the 1960s, South African mines had been responsible for more than half of the gold in circulation globally (not without controversy – that we will dig into later).

Why The Witwatersrand Gold Deposits Are So Big

Pre-history (circa 3.1 billion years ago) the “Witwatersrand Basin” held an ancient inland sea. A sunken depression in the region known as the “basin” gathered water through ancient rivers that flowed through mountains located to the west, north, and east. Sediment from these rivers contained gold specs that ran into the inland sea and gathered into pockets.

The goldfield is roughly 100 kilometers (60 miles) long and 3.6 kilometers (12,000 feet) deep in places.

With a 56-kilometre (34 mile) section consisting of a hard, erosion-resistant quartzite rock, over which several north-flowing rivers form waterfalls. The “Witwatersrand” or “white water ridge” when directly translated from Afrikaans refers to the still visible waterfalls of the region.

Gold can be found embedded in conglomerate rocks along with other minerals known as “reefs”. These geological formations are known as placer deposits, where the weight and resistance to weathering allows gold to accumulate into the “veins” in the rock, that are mined to this day.

South Africa’s gold production legacy is anchored in its vast network of rich gold reefs.

The most significant of these include the Basal Reef in the Free State, the Carbon Leader Reef in Carletonville, the Kimberley Reef in Evander, and a series of reefs such as the Main Reef and Main Reef Leader across the West, Central, and East Rand.

Others, like the Middelvlei and South Reefs, also in Carletonville, and the Vaal Reef in Klerksdorp, alongside the Ventersdorp Contact Reef, are equally important. Collectively, these reefs have historically yielded ore that is richer and more abundant than any other gold deposits found worldwide.

Over billions of years, these gold-rich layers were deposited and are now found as deep as 4 kilometers underground.

In order to extract this gold, deep-level mining needed to and was pioneered in South Africa. With depths reaching almost 4 kilometers these mines are hot and dangerous places and innovations such as ice slurry, cooling and deep level ventilation systems. South Africa rapidly became a world leader in deep mining technology, developing ultra-deep-level mining techniques and machinery, that have since been adopted worldwide.

At its peak, the industry contributed significantly to the nation’s GDP and employed hundreds of thousands of workers. Gold mining spurred the development of numerous satellite industries, from engineering to financial services, contributing to the country’s infrastructural and economic development.

Despite the vast wealth generated, South Africa’s gold industry faces significant challenges. Gold veins are becoming depleted, and the remaining reserves are increasingly difficult and costly to extract. Moreover, the industry has been plagued with issues such as labor disputes, safety concerns, and environmental impacts. These factors have led to a decline in production and have seen South Africa slip from its position as the top gold producer.

Since the 1980s, as gold prices have climbed, gold mining has expanded globally. From the late 1800s to around 2006, the country held the title of the world’s largest gold producer, largely thanks to the prolific output from the Witwatersrand Basin. By 2007, China had overtaken all other nations to become the leading gold producer, and currently, gold is being extracted in more than 40 countries worldwide.

For decades, South Africa had significant influence over the global gold market, even impacting global prices with its production policies. However, as production has declined, other countries like China, Australia, and Russia have increased their output, reducing South Africa’s dominance.

US and Europe’s Role in Apartheid Gold

The abundance of gold ore in South Africa was deceptive; the veins were buried deep and contained sparse amounts of gold, demanding intensive, deep-level mining to yield profits. This necessitated hefty capital investment and more advanced technology. To streamline operations and minimize competition, particularly for labor, over 100 companies were structured into nine conglomerates, or “groups.” Ernest Oppenheimer founded the Anglo American Corporation in 1917 with the financial assistance of J. P. Morgan with initial capital of £1m. Half the capital came from the US and half from England and SA, forming the companies name “Anglo American” that is still in use today.

This arrangement set a precedent for labor practices, wages, and accommodation within the industry, influencing broader socioeconomic patterns.

The gold industry played a controversial role during the Apartheid era, with mines often relying on cheap, migrant labor under harsh conditions. Post-Apartheid, the industry has seen reforms aimed at improving labor conditions and promoting black economic empowerment. However, the industry’s transformation has been complex and is still a subject of intense political and social debate.

South Africa’s gold mining industry, has a history marked by exploitation and inequality.

Deep-seated gold deposits necessitated substantial investment in underground operations from the outset, leading to the control of the gold industry by diamond magnates known as randlords, including figures like Cecil John Rhodes and the afore mentioned Ernest Oppenheimer. To staff the mines, a large workforce was required; in 1980, the industry employed 472,000 workers, with a stark racial disparity in employment.

Discriminatory laws and taxes, including the 1913 Native Land Act, stripped black South Africans of land rights, coercing them into mining labor. These policies not only fueled the gold sector but also sowed the seeds of ongoing social unrest and vast economic disparities between workers and mine owners.

The discovery of gold in the late 1880s in South Africa attracted a surge of prospectors and intensified political tensions, contributing to the outbreak of the Second Boer War in 1899, which resulted in nearly 100,000 deaths. The aftermath of the war also fostered Afrikaner nationalism, which laid the groundwork for the apartheid regime. During apartheid, as international sanctions began to hit South Africa’s trade and finances, the regime relied heavily on gold sales for survival.

The London Gold Pool initially allowed South Africa to trade gold despite sanctions, but its collapse in 1968 led to the creation of the Zürich Gold Pool by major Swiss banks, which then became a lifeline for the apartheid government. Switzerland, through its banks and despite public disapproval of apartheid policies, played a pivotal role in marketing South Africa’s gold and diamonds, and even assisted in the country’s debt restructuring in the mid-1980s.

Essentially The London Gold Pool was an agreement between eight central US banks and seven European countries (Germany, the United Kingdom, France, Italy, Belgium, Netherlands and Switzerland) to maintain the price of gold and the Bretton Woods System of fixed exchange rates.

The United States Federal Reserve played a pivotal role in this agreement. Specifically, the Federal Reserve Bank of New York acted on behalf of the U.S. Treasury and was responsible for providing half of the gold used to intervene in the London gold market.

In the United States, the central banking system is composed of the Board of Governors of the Federal Reserve System (commonly known as the Federal Reserve Board), located in Washington, D.C. and 12 regional Federal Reserve Banks. The Federal Reserve Bank of New York is one of these regional banks and is the largest by assets and the most influential of the regional banks due to its proximity to Wall Street and its responsibility for conducting open market operations.

The U.S. participation in the London Gold Pool was a significant aspect of the country’s broader economic and monetary policy during the 1960s. By supplying gold to regulate the market price, the U.S. and its central bank, the Federal Reserve, sought to preserve the credibility of the dollar and the stability of the international monetary system.

The Swiss government has been criticized for its role in these transactions, which Professor Mark Pieth likens to gold laundering.

Pieth contends that the Swiss were complicit, evidenced by their reluctance to release trade statistics or allow access to archives that could shed light on the extent of Switzerland’s involvement in upholding the South African apartheid economy. According to research, up to 80% of South African gold imported to Switzerland during the 1980s was processed and stamped with Swiss quality seals, reinforcing the view that Switzerland’s actions during that period were, at least economically, supportive of the apartheid regime.

During the apartheid era, The Rand Refinery played a significant role in the South African economy, refining gold for the government, which was then used to produce Krugerrands for international trade, circumventing sanctions.

Future of Gold in South Africa

The future of gold mining in South Africa is rooted in improving the efficiency of existing resources and seeking new mining opportunities. Enhanced safety and cost-effectiveness in deeper mining levels are being supported by technological advancements such as seismic technology and biomining. Exploration is expanding into untapped greenstone belts within and around South Africa, driven by investments in sophisticated methods that hold the promise of new discoveries.

Data analytics and artificial intelligence are now pivotal in optimizing mine planning and processing, contributing to reduced operational costs and the potential extension of mine lifespans. Critical to these endeavors is the supportive role of the South African government, which is focused on establishing policies that enable investment and environmental stewardship while ensuring equitable benefits to all stakeholders.

Although no longer dominating the global gold production, South Africa’s gold mining sector continues to forge a new path through technological and strategic advancements, maintaining its significant legacy in the industry and shaping its role in the continent’s mining future.

FAQ

Why did South Africa stop producing so much gold?

A global gold price collapse in 1989 from $900 per ounce to about $300 meant that many South African mines were becoming less profitable as apartheid ended. This set the stage for decades of decline.

What happened to South African gold?

South African gold output has been declining for several decades now. From a peak of around 1,000t in 1970, the nation’s gold output fell to 130t in 2018. A combination of closure, maturing assets and industrial strife has created an inhospitable operating environment.

What happened after the discovery of gold in South Africa?

Gold increased trade between South Africa and the rest of the world. For the main trading nations, i.e. Europe and the United States, gold was of value because their currencies were backed by gold. This was known as the gold standard.

Why South Africa has so much gold?

Approximately 2.7 billion years ago, the supply of sediments into the basin ended as voluminous flood basalts covered the Witwatersrand basin. More than seven kilometers of sedimentary rocks interspersed with gold-rich conglomerates were buried beneath several more kilometers of lavas and other rocks.

How long will gold last in South Africa?

South Africa’s overall mining profits slipped by more than $5 billion in the last financial year, while the country that was once the world’s largest gold producer might have less than 30 years of a viable gold industry left without renewed investment, according to a new report.

Is gold still being mined in South Africa?

According to GlobalData, South Africa is the world’s eighth-largest producer of gold in 2022, with output up by 3% on 2021. Over the five years to 2021, production from South Africa decreased by a CAGR of 5.66% and is expected to rise by a CAGR of 4% between 2022 and 2026.

Who owns the gold mines in South Africa?

The South Deep Gold Mine is owned by Gold Fields Ltd which is due to operate until 2106, the Impala Mine is owned by Impala Platinum Holdings Ltd which is due to operate until 2035 and the Tshepong Mine is owned by Harmony Gold Mining Co Ltd which is due to operate until 2041.

Who controls the gold in South Africa?

The Department of Finance at the time (now known as the National Treasury) appointed the SARB as its agent to manage South Africa’s official gold reserves and market the country’s gold output.

Is there gold in South African rivers?

Witwatersrand Basin – Hartbeespoort, South Africa – Atlas Obscura

South Africa is famous for its rich deposits of gold, the vast majority of which come from the Witwatersrand Basin, an underground geological formation believed to have once been the floor of a prehistoric sea where rivers deposited their sediments, forming gold and other minerals.

Is there still gold in Witwatersrand?

Today, the Witwatersrand reef is part of the “golden arc,” an ancient inland lake containing rich deposits of alluvial gold . This massive goldfield is 100 kilometers (60 miles) long and 3.6 kilometers (12,000 feet) deep in certain places. It is the source of over 40% of the gold extracted from the Earth.

Which country has most unmined gold?

Australia and Russia hold a large share of the world’s gold mine reserves, accounting for 8,400 metric tons and 6,800 metric tons, respectively.

Which countries buy gold from South Africa?

The main destination of Gold exports from South Africa are: China ($5.05B), India ($4.1B), Switzerland ($3.67B), United Kingdom ($2.47B), and United Arab Emirates ($2.08B).

- A Chat with Nate and Mika, Christian Wedding Photographers - July 18, 2024

- Ultimate Guide To Playing Online Casinos - May 27, 2024

- Addiction Recovery Books Worth Reading - January 24, 2024