Dealing with debt can be overwhelming, but there are strategies to help you regain control of your finances. Two popular methods are the Debt Snowball and the Debt Avalanche. In this ultimate guide, we'll explore these approaches and help you determine which one is the right fit for you. Get...

Investing During A Recession: Do’s And Don’ts

When economic downturns loom like dark clouds over the financial markets, it's not unusual to feel a tinge of trepidation with every investment step. The unsettling waves of a recession, though seemingly perilous, can harbor unique opportunities for the strategic investor. Do’s: Be the Buoyant Investor Amidst the Storm Embrace...

Financial Literacy For College Students: What You Should Know

Hey there, future financial wizards! I'm Darren, and while I usually chat about camping and RV lifestyles, today we're setting up camp in the world of financial literacy, specifically for college students. College can be a whirlwind of experiences, and it's also the perfect time to build a strong financial...

How To Cut Unnecessary Expenses: A Guide

Are you tired of watching your hard-earned money disappear into a black hole of unnecessary expenses? It's time to take control of your finances and trim the fat from your spending habits. In this comprehensive guide, we'll show you practical steps to cut unnecessary expenses and build a healthier financial...

Loan Agreement Templates: What To Include

Whether you're borrowing money from a friend or family member, or taking out a loan from a bank or other financial institution, it's important to have a written loan agreement in place. This document will protect both you and the lender, and help to ensure that everyone is on the...

How To Set Financial Goals And Achieve Them

Ever found yourself thinking, "If I just had a bit more money, everything would be easier?" Well, newsflash: It's not always about having more but managing better. Whether you're dreaming of a lavish vacation, hoping to buy a house, or just looking to stop living paycheck to paycheck, setting clear...

The Importance Of Risk Tolerance In Investing

Investments can stir up a mix of emotions - the thrill of potential gains and the apprehension over losing your hard-earned cash. Risk tolerance isn’t just a fancy term; it’s your personal financial emotion meter and having a grasp on it means understanding how much financial fluctuation you can handle...

Budgeting For Specific Needs

As a camper and RV enthusiast, I know that budgeting is essential. I need to make sure that I have enough money to cover the cost of gas, food, camping fees, and other expenses. But I also need to be mindful of my budget and avoid overspending. That's why I'm...

Financial Planning

Hey there, it's Jane! When I'm not exploring nature in my RV, I'm navigating the winding trails of personal finance. Just as we plan our camping trips down to the last marshmallow, mapping out our financial journey is just as crucial. If you're wondering how to get started or what...

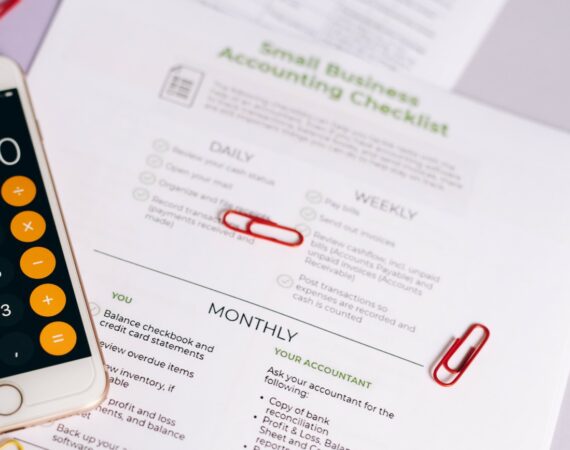

How To Analyze Monthly Expenses: Templates And Tips

Analyzing your monthly expenses is a vital step in gaining control over your financial well-being. It helps you understand where your money goes, identify areas for improvement, and work towards achieving your financial goals. In this comprehensive guide, we'll walk you through the process of analyzing your monthly expenses, provide...

Quick Back-to-School Shopping Tips To Save Money

1. Start with a Shopping List Before you hit the stores or go online, create a shopping list. Take inventory of what your child already has and what they need. This list will be your roadmap to efficient shopping and help you avoid impulse purchases. It's a simple step that...

Socially Responsible Investing: What You Need To Know

Socially responsible investing (SRI), also known as environmental, social, and governance (ESG) investing, is a type of investing that considers the social and environmental impact of companies and funds before investing. SRI investors are interested in supporting companies that are making a positive impact on the world, while also generating...

NADA RV Private Party Value: A Quick Estimation Guide

Determining the value of your RV is much like gauging the worth of your camping gear before embarking on a new adventure. It's an essential step in the RV lifestyle. I'm Jane, and in this guide, I'll walk you through the process of estimating the private party value of your...

How To Use Buy Now, Pay Later Services: A Quick Guide

Buy now, pay later (BNPL) services are a popular payment option that allows you to purchase items and pay for them in installments over time. BNPL services can be a great way to finance large purchases or unexpected expenses, but it's important to understand how they work before you use...

Top 5 Investment Apps For Beginners

1. Robinhood: Simplifying Stock Trading Robinhood is an excellent choice for beginners who want to dip their toes into the world of stock trading without paying hefty commissions. This app offers commission-free trading, which means you can buy and sell stocks without the burden of trading fees. The user-friendly interface...